You've worked your tail off to build your business. You've survived the sleepless nights, the cash flow crunches, and that terrifying moment when you first signed a lease. But here's the thing that keeps me up at night as someone who helps business owners protect their wealth: most of you are making critical insurance mistakes that could wipe out everything you've built.

And it gets worse. Many business owners don't realize that their choice between an LLC and corporation isn't just about taxes, it completely changes their insurance needs too.

Let me share what I've learned from working with hundreds of business owners who thought they had it all figured out... until they didn't.

The Insurance Mistakes That Are Costing You Big Time

Mistake #1: Playing the "Cheap Insurance" Game

I get it. Insurance feels like throwing money into a black hole. So you shop around, find the cheapest policy, and pat yourself on the back for saving a few hundred bucks a month.

Here's what happened to Mike, who owns a small manufacturing company in Ohio. He saved $200 a month by choosing basic property coverage with rock-bottom limits. When a fire destroyed his warehouse last year, his insurance covered maybe 40% of the actual replacement costs. The "savings"? They cost him his entire business.

The real cost: Underinsuring your property is like buying a parachute with holes in it. Sure, it's cheaper, but you're going to have a bad time when you need it most.

Mistake #2: The Deductible Trap

Higher deductibles mean lower premiums, right? Smart business move? Not always.

I've seen too many business owners choose $10,000 or $25,000 deductibles to save on monthly premiums, then face a crisis when they can't afford the deductible during a claim. Your business is already stressed from whatever caused the claim, now you're scrambling to find cash for the deductible too.

Rule of thumb: Only choose a deductible you can comfortably write a check for tomorrow without checking your bank balance twice.

Mistake #3: Treating Your Insurance Agent Like a Stranger

You wouldn't hire an employee and then hide half the job description from them. So why do business owners constantly hide information from their insurance providers?

Revenue jumped 300% this year? Your agent needs to know. Added a new service line? That's crucial information. Started working with hazardous materials? Definitely relevant.

When you withhold information, you're not saving money, you're creating coverage gaps that could sink your business when you need protection most.

LLC vs. Corporation: The Tax Maze That Affects Your Insurance

Now, let's talk about something that makes most business owners' eyes glaze over: the tax differences between LLCs and corporations. But stick with me, because this directly impacts how much insurance you need and how you should structure it.

LLCs: The Pass-Through Champion

With an LLC, you're looking at pass-through taxation. That means business profits flow straight to your personal tax return. Sounds simple, right?

Here's the catch: you're paying self-employment taxes of 15.3% on your entire share of business profits. That's 12.4% for Social Security and 2.9% for Medicare. For a profitable business, this adds up fast.

Let's say your LLC makes $200,000 profit. You're paying $30,600 in self-employment taxes alone, plus your regular income taxes on top of that.

Corporations: The Double-Taxation Dilemma

C-Corporations face what everyone calls "double taxation." The corporation pays 21% corporate tax on profits, then you pay personal income tax when those profits are distributed as dividends.

But here's what most people miss: if you're working in the business, you can take a salary (subject to payroll taxes) and receive additional distributions that aren't subject to self-employment tax.

For profitable businesses, this can actually result in lower overall taxes than an LLC structure.

The S-Corp Election Game-Changer

Here's where it gets interesting: both LLCs and corporations can elect S-Corp tax status. This lets you potentially reduce self-employment tax exposure while keeping pass-through taxation benefits.

It's like getting the best of both worlds, but with more paperwork and compliance requirements.

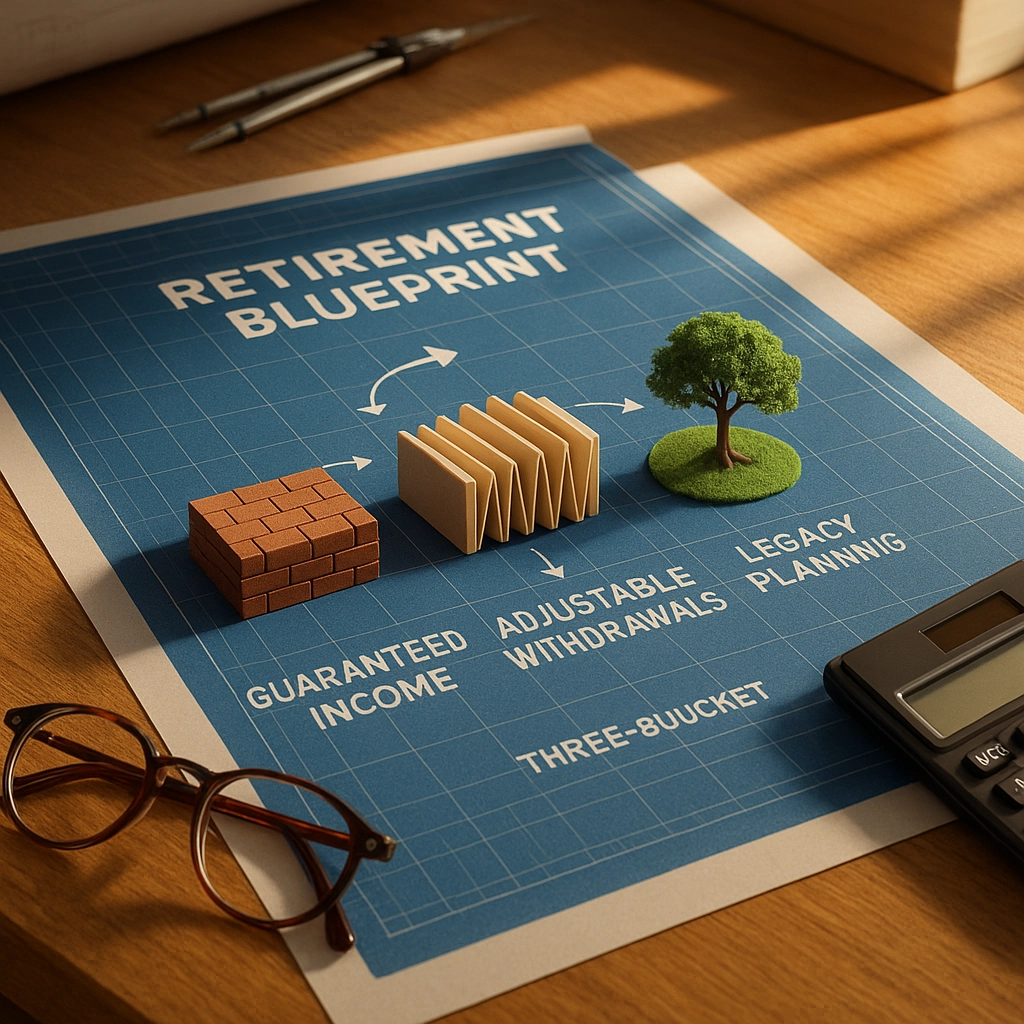

How Your Business Structure Changes Your Insurance Needs

Your choice between LLC and corporation doesn't just affect taxes, it completely changes your liability protection and insurance requirements.

LLC Liability Protection

LLCs offer something called "charging order protection" in most states. This makes it extremely difficult for personal creditors to seize your business ownership interests. Your personal assets get protection from business creditors, and you're protected from other members' actions.

What this means for insurance: You might need different liability limits because your personal exposure is different.

Corporation Liability Protection

Corporations offer the classic "corporate veil" protection, but only if you maintain proper corporate formalities. Miss those required meetings, mix personal and business expenses, or skip the paperwork? You could lose that protection entirely.

What this means for insurance: You need to consider both corporate liability coverage and potential personal exposure if the corporate veil gets pierced.

The Real-World Example That Changed Everything

Let me tell you about Sarah, who runs a successful marketing agency. She started as an LLC, chose minimal insurance to save money, and thought she was smart by keeping everything "lean and mean."

When a client sued her for $500,000 over a campaign that allegedly damaged their reputation, she discovered three problems:

- Her general liability coverage had a $300,000 limit

- Professional liability? She didn't have any

- Her LLC structure provided some protection, but not enough for this size claim

The lawsuit took two years to resolve. Legal fees alone cost $150,000. The settlement? Another $200,000. Her "money-saving" insurance strategy cost her more than comprehensive coverage would have cost for 20 years.

But here's the kicker: after working with our team, Sarah switched to S-Corp election for tax benefits and implemented a comprehensive insurance strategy that actually costs less per year than what she spent on legal fees in just one month of that lawsuit.

Your Next Steps: Don't Let These Mistakes Sink Your Business

Look, I've been in this business long enough to know that most business owners will read this, nod along, and then... do nothing. Please don't be that person.

The combination of proper business structure and adequate insurance isn't just protection: it's a competitive advantage. While your competitors are playing defense with inadequate coverage and suboptimal tax strategies, you'll have the peace of mind to focus on growing your business.

Here's what you need to do right now:

- Review your current insurance coverage - When's the last time you actually looked at your policy limits?

- Evaluate your business structure - Are you paying more taxes than necessary?

- Get professional guidance - This isn't a DIY project

The cost of getting this wrong isn't just money: it's your business, your family's security, and everything you've worked to build.

Don't wait until you're facing a crisis to realize you've been making these mistakes. The best time to fix your insurance and business structure was five years ago. The second-best time is right now.

Ready to protect what you've built? Schedule a consultation with our team and let's make sure you're not making these costly mistakes. We'll review your current situation and show you exactly how to optimize both your business structure and insurance strategy.

Your future self will thank you for taking action today instead of hoping nothing bad ever happens to your business.